Other Names

- Cudgeong abattoir

Current Operation

Location

- Mudgee is located 120 kilometres north of Lithgow in NSW on the western side of the Great Dividing range.

Hema Maps – Australia Truckies atlas.

Owner

- Cudgegong Shire Council ( ? – 1988)1

- Flectcher International exports – 19881

Operation

- Last council-owned meatworks to survive the rationalisation of the meat processing industry1

History

1965

- Built as a service works for local butchers2

1981

- Roger Flectcher – started his meat processing career when he leased the boning room at Mudgee and operated until 19882 when he built Dubbo abattoir (NSW)

1996

- Up to half of NSW abattoirs could close with the loss of up to 5,000 jobs1

- abattoirs are outdated and inefficent1

- Beef export abattoirs at Wingham (NSW), Mudgee (NSW), Gunnedah (NSW) and Inverell (NSW) are most at risk to close1

- Small number of modernised plants likely to survive restructuring Young (NSW), Cootamundra (NSW), Gundagai (NSW), Culcairn (NSW), Harden (NSW)1

- Handful of efficient and niche market operators insulated from fall out Casino (NSW), Macksville (NSW), Scone (NSW) and Lismore (NSW)1

- New privately owned and speciality sheep plants such as Goulburn (NSW) and Dubbo (NSW) killing 60% of NSW mutton are examples of what can be achieved by investment in capital1

- Increased US beef into previous Australian market share in Japan, Korea and Taiwan increased pressure1

- Live export of 500,000 cattle to Indonesia and Philippines increased pressure on operations of beef processing abattoirs1

- Authors Note – Majority of live export cattle during this period would have been Bos Indicus or crosses to South East Asia markets, sourced from mainly northern Australia. Not animals suited to heavy slaughter in Australia and from herds whos’ production was not likely destined for abattoirs in NSW.

Source – Live Cattle Exports. Australian Commodities Vol 5 #2 June 1998

Source – Live Cattle Exports. Australian Commodities Vol 5 #2 June 1998

Chart showing the high volume of South East Asia live cattle export destinations period 1990 – 1998

2003

- August. Mothballed1

- Had employed 230 people1

- Accumulated debts of $13M, had appointed an administrator.2

- 2002/2003 processed2

- 32,000 cattle2

- 600,000 sheep, lambs and goats2

- 1,300 deer2

- Liquidator – Steve Parberry of PPB chartered accountants2

- Tender Sale conducted by David Nolan Rural and Project marketing2

- Previous 5 years of operation it had worked almost entirely for 5 major export customers including2

- Mudgee co-op for sheep2

- Melbourne beef processor – GH Keily2

- December. Purchased by Fletcher International Exports.1

- Fletchers own Dubbo abattoir (NSW) and Katanning (WA)

- Would be atleast a year or later before the plant will be sufficently renovated to enable operation1

- $3M rebuilding program at the plant1

- New freezers would need to be installed to allow for more freezer capacity1

- the current coal-fired boilers need to be replaced with natural gas to cut operating costs1

- Beef line was good, boning room had heavy investment1

- Utilise as a single species abattoir – beef1

- enable plant better chance to survive as cattle numbers not as severely depleted due to drought1

- $3M rebuilding program at the plant1

Sources

- ‘Abattoirs revived’ Stock and Land 24.12.2003

- ‘Meatworks jobs saved’ The Land 25.12.2003

- 5,000 jobs at risk:Abattoirs facing closure’ Sydney Morning Herald. 21.05.1996

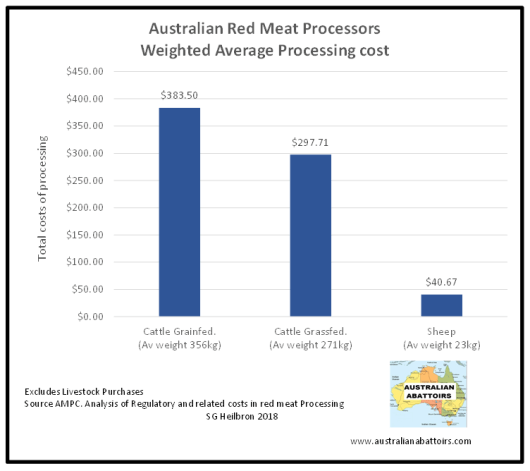

Key Cost Components Australian Cattle 2015/ 2016. 100% costs excluding Livestock purchase

Key Cost Components Australian Cattle 2015/ 2016. 100% costs excluding Livestock purchase